The size of the elderly population has risen from 12.1 million in 1901 to approximately 77 million in Census 2001. According to official population projections, the number of elderly persons will rise to approximately 140 million by 2021.Main contributor of this change is changing demographics, Urbanization,

Life expectancy at birth is approximately between 70 years to 74 years. while at age 60 life expectancy is 18 to 20 more years. i.e around 78 to 80 and more. This means no years in retirement has increase so planning for the retirement becomes very crucial for any one. so that you are not dependent on any one in later years of life and have enough corpus to pull through.

As per the Indian social structure one enters in to “vaanprasthashram” only after performing duties of “grahasthrashram” i.e fulfilling dreams of children’s education, marriage , settling in life,business start up of children or career and then one thinks about Retirement. All these are also important stages of life to be taken care of along with the retirement and protecting investment and all this life stages are important as it ultimately affect the retirement planning. Most of the time during working life cycle i.e 21 to 50 where the responsibility are growing and between 45 to 55 at their pick. Most of the time an Individual bread earner of the family end up using his retirement fund for his children’s higher education or marriage. and at the time of retirement starts his second working life. This is the scenario of 50 % of Indian population above 60.

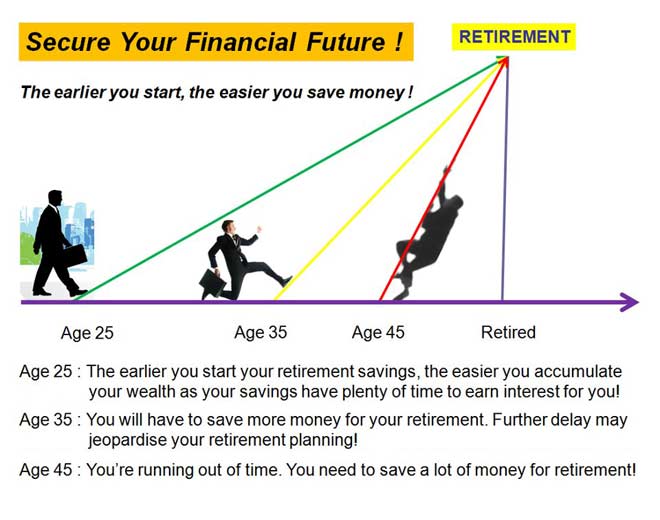

Early in your career is the perfect time to start a habit of saving for retirement because you have one huge advantage you’ll never get again…TIME. You may shake your head at the recommendation of setting aside money for something you won’t need for 30 or 40 years, you may want to enjoy new feelings of independence o money and want to spend in leisure activities.Time will either work for you or against you when saving for retirement, and it’s a lot easier when time is on your side. only 10 % of the income is required to save for golden years. If at 25 years of age if you start saving Rs.2000/month for 35 years till your age 60 at only 8% it will accumulate Rs.4587765/- If you start at 35 years age 10 years later.. you will have just Rs.19 lac. Power of compounding works well when start early.

At this stage, you’re likely full stride into your career and your income probably reflects that. The challenge to saving for retirement at this stage comes from large competing expenses: a mortgage, raising children and saving for their college, or perhaps financing your business. Time is still on your side, though you’ve begun to lose some of your compounding power. Try to invest a minimum of 10 percent of your salary towards retirement. At this stage you still think that saving for your children’s higher education is important as its knocking door its near but ignoring or postponing Retirement planning does not make sense as the children may fund their education through study loan which are available. Do not even hamper the retirement saving for down payment of loan

Now is the last opportunity to really sock away .gear for retirement funds. Try to boost your retirement savings goal up to 20 percent or more of your income. Ideally, you’re at your peak earning years and some of the major household expenses, such as a mortgage or child-rearing, are behind you, or soon will be. This is the final call for saving for Retirement. The more you can save it is better. At this life stage saving for retirement one has to be very caustious as Time is now on the other side you have less time for power of compounding. Right asset mix to invest is ver important major part is recommended in secure funds ,bondsetc and to fight inflation some part also should be in equity and mutual funds under guidence of expert.